To address changes in the industry market and accurately understand the development environment of ports, this article analyses the market situation for major cargo types handled in port operations, including containers, coal, minerals, crude oil, grain, and commercial vehicles, at Chinese ports.

Containers

2025 China port container handling market analysis

In 2024, demand from overseas markets such as Europe and the United States increased. The Red Sea crisis caused a significant diversion of international trade routes around the Cape of Good Hope in South Africa, absorbing the growth in shipping capacity (with new container ship deliveries reaching a record high of 3.1 million TEU in 2024, and the global total container ship capacity reaching 30.8 million TEU by year-end). Meanwhile, some countries raised import tariffs on Chinese goods, causing inventory demand to be brought forward and shippers to ship goods earlier, further driving freight demand growth. Domestic ports performed well in the ‘new three major export sectors’ of new energy vehicles, lithium batteries, and photovoltaics. In the domestic market, demand for container transport has grown steadily, but the continued delivery of new domestic vessels in the first half of the year has exacerbated the imbalance between supply and demand, leaving domestic shipping companies operating at break-even levels. However, with the continued rise in international freight rates in the second half of the year, some vessels operating both domestically and internationally have gradually shifted to the international market, leading to an overall improvement in market conditions.

By 2025, Clarkson predicts global container shipping trade volume will grow by 2.9%, with container shipping capacity increasing by 6%. Although external market demand is in a restocking cycle, the recovery of the Red Sea route will exacerbate the risk of excess capacity. Tariff barriers faced by China may prompt some goods to continue diverting to other countries for transshipment, thereby altering existing transport routes and demand structures. Considering factors such as shipping alliance restructuring and stricter environmental regulations (e.g., the use of low-Sulphur fuel or the installation of desulphurization equipment on vessels, and the EU’s carbon emissions compliance target increasing to 70%), shipping companies are facing increased operational cost pressures, which may be passed on to ports. In the domestic shipping sector, under the influence of the country’s loose monetary policy and measures to expand domestic demand and promote consumption, the domestic shipping market is expected to improve overall. Meanwhile, approximately 50,000 TEU of shipping capacity is expected to be delivered in 2025, a decrease of 46.8% compared to 2024, with the growth rate of domestic shipping capacity slowing down, and the supply-demand balance for shipping capacity is expected to improve. In terms of promoting the ‘bulk to container’ business, the port’s ‘bulk to container’ business faces challenges due to the continued sluggishness of the real estate industry, the continued decline of traditional grain and building materials markets, and the decline in demand for coal shipping.

GBM container spreader model recommendations

GBM electrical-hydraulic telescopic spreader

Coal

2025 China port coal market analysis

In 2024, the domestic coal market overall presented a ‘strong supply, weak demand’ pattern. On the supply side, affected by factors such as production safety, environmental protection, and overproduction inspections, domestic coal production reached 476 million tons for the year, representing a year-on-year increase of 1.3%; under the continued price advantage of imported coal, coal imports for the year reached 54 million tons, representing a year-on-year increase of 14.4%.On the demand side, the slow growth of industries such as steel and cement, coupled with the rapid expansion of clean energy generation (hydropower, wind power, and solar power generation increased by 10.7%, 11.1%, and 28.2% year-on-year, respectively, while thermal power generation grew by only 1.5%), and the impact of unusually high winter temperatures, resulted in overall weak demand for coal.In the first half of the year, some railway bureaus introduced freight rate reduction policies, leading to a decrease in transportation costs and an increase in port arrivals. However, downstream users remained reluctant to purchase, resulting in a synchronous increase in inventory levels at Bohai Rim ports and downstream terminals. Coal inventory at the four northern ports peaked at over 3 million tonnes.

By 2025, with the continued relaxation of real estate-related policies and ongoing efforts to promote consumption upgrades, overall market vitality is expected to improve. On the supply side, due to environmental protection policies, the likelihood of a significant increase in domestic coal supply in the long term is low, with raw coal production projected to grow by 1.2% year-on-year in 2025. On the import side, influenced by factors such as prices and domestic inventory levels, coal imports are expected to continue growing in the first half of the year, but the growth rate may slow in the second half. On the consumption side, clean energy will become the primary channel for power growth. With new installed capacity growing by 25% year-on-year in 2024, clean energy power generation will continue to grow significantly, maintaining its strong substitution effect on traditional thermal power. In the long term, coal will primarily serve as a storage fuel and for peak load regulation, playing a foundational, supportive, and backup role. It is projected that by around 2025, the share of coal in total primary energy consumption will reach its peak, approximately 50%, while the share of non-fossil energy will increase to 18%. Price reductions in electricity rates in some coastal regions and increased ultra-high voltage power transmission from production areas will also impact coal procurement enthusiasm. In addition, factors such as the growth of some railway transport capacity and its connection to canal transshipment, the opening of dedicated lines for power plants, and the direct delivery of coal to power plants by rail will also have an impact on coal transshipment at riverside ports. It is expected that in 2025, the overall coal market will be in a state of ‘tight supply and demand balance.’

GBM Coal Grab Recommendations

GBM Remote Control Coal Grab

Ore

2025 China port ore market analysis

In 2024, coal shipments from major overseas iron ore production regions remained at high levels, coupled with the advancement of China’s ‘Foundation Plan,’ leading to increased domestic iron ore supply. The domestic iron ore market overall presented a ‘supply exceeding demand’ situation.Due to the downturn in real estate and infrastructure projects, construction starts have significantly decreased, steel sales have fallen short of expectations, and domestic steel mills have maintained relatively low overall operating rates. In 2024, the national daily average production of pig iron was 2.29 million tonnes, a year-on-year decrease of 3.8%. In 2024, the national import volume of iron ore reached 123.7 million tonnes, a year-on-year increase of 4.9%.Port inventories have continued to grow since October 2023, reaching a peak of 159 million tonnes, indicating that the increase in imports has largely been converted into port inventories.

In 2025, the infrastructure sector may continue to face downward pressure, with domestic steel plant capacity expected to remain largely unchanged. Excess capacity will lead to long-term operational challenges for steel companies, and loss pressures may trigger large-scale plant shutdowns for maintenance. Additionally, as the ‘Foundation Plan’ progresses, domestic supplies of iron ore and scrap steel are both expected to increase. Furthermore, as some foreign countries have successively imposed tariffs on steel products, this has created pressure on China’s steel exports, which in turn may be transmitted to iron ore imports. All these factors could lead to a decline in demand for imported iron ore. At the port level, if overseas production areas maintain active shipments and port arrivals do not decrease, and if the inventory digestion capacity of inland steel mills reaches its limit, port stockpiling pressure may continue to intensify.

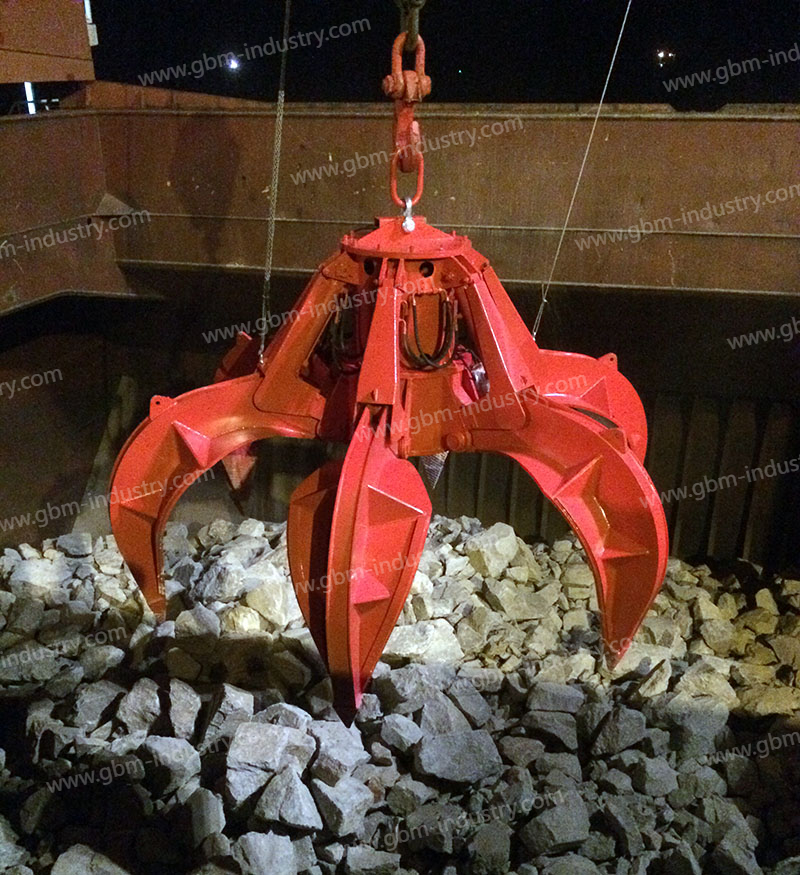

GBM ore grab recommendations

GBM electrical-hydraulic orange peel grab

GBM ore ship loader model recommendations

GBM 1000tph iron ore ship loader

Crude oil

In 2024, influenced by geopolitical conflicts, U.S. interest rate cuts, and OPEC+ production cuts, international crude oil prices exhibited a clear ‘high-to-low’ trend, particularly as market demand declined, causing oil prices to enter a downtrend starting from the second quarter, with the annual average price maintaining around 80 USD per barrel. Due to factors such as economic growth slowdown and faster growth in new energy, China’s crude oil imports for the year reached nearly 553 million tonnes, a year-on-year decrease of 1.9%.

In 2025, global crude oil supply is expected to remain relatively ample, with the OPEC+ crude oil production target set at 39.725 million barrels per day, and conventional oil production from non-OPEC countries projected to increase by 800,000 barrels per day. Meanwhile, constrained by factors such as the global economic slowdown, the domestic energy structure shifting toward a more green and sustainable direction, and the weakness of manufacturing in Europe and the United States, market expectations for crude oil demand growth have been continuously downgraded, exacerbating supply-demand imbalances. The global crude oil market may face a supply surplus in 2025.In terms of prices, global oil prices are expected to follow a fluctuating downward trend in 2025, with the average price for the year significantly lower than that of 2024, estimated at USD 75 per barrel. In 2025, China’s crude oil production is expected to reach 218 million tonnes, with imports reaching 572 million tonnes, and the crude oil supply market will continue to rely on imports.

Grain

In 2024, China’s grain production exceeded 700 million tonnes, with relatively adequate market supply. Overall grain imports remained at a high level throughout the year, with soybean imports reaching 105 million tonnes, up 6.5% year-on-year, and corn imports reaching 13.64 million tonnes, down 49.7% year-on-year. In 2024, driven by lower corn prices, to ensure food security, China successively implemented measures such as adjusting bonded processing policies, suspending the approval of state-owned import quotas, and extending the processing time for import grain quarantine permits to restrict imports, resulting in a significant reduction in the volume of imports arriving at ports. On the demand side, flour and rice processing enterprises maintained relatively low operating rates throughout the year, feed production decreased year-on-year, and most enterprises maintained low inventory levels, leading to overall weak demand.

In 2025, affected by restricted grain import policies, domestic import arrivals will remain at low levels in the first half of the year, with market supply primarily relying on domestic grain. Among these, soybean imports will continue to remain at high levels: on one hand, global soybean supply remains relatively ample, import costs are expected to decline, and the state will continue to build soybean reserves; on the other hand, as the profitability of domestic livestock farming continues to improve, livestock farming scale is expected to expand, thereby driving soybean demand. Corn imports are likely to continue to decline. With the continued growth of domestic corn production capacity and the continuous strengthening of the supply security of domestically produced corn, China’s corn production-demand gap has narrowed significantly, and import demand has weakened significantly. In the future, the corn market will remain weak.

GBM Grain Grab Recommendations

GBM Leak-proof Remote Control Grab

Commercial Vehicles

In 2024, driven by national policies to stimulate automobile consumption, the automobile market saw enhanced vitality, with China’s annual automobile production and sales reaching 31.282 million units and 31.436 million units, respectively, representing year-on-year increases of 3.7% and 4.5%.Among these, new energy vehicles continued their rapid growth trend, with annual production and sales exceeding 1 million units for the first time, accounting for approximately 40% of total sales. In 2024, China’s automobile exports continued to grow at a relatively fast pace, with total exports reaching 5.859 million units, up 19.3% year-on-year. Currently, China’s new energy vehicle market overall exhibits a ‘strong south, weak north’ pattern in terms of regional layout and consumer demand, with northern automakers, which primarily produce traditional fuel-powered vehicles, facing sustained pressure on production and sales.

In 2025, driven by policies promoting the replacement of old vehicles with new ones and stable automobile exports, domestic automobile production and sales are expected to maintain a growth trend .It is expected that the proportion of new energy vehicle production will continue to expand, reaching approximately 45%, while traditional fuel vehicle production will decline. In terms of exports, some foreign regions have increased import tariffs on Chinese automobiles, which may impact the export of finished vehicles. However, from the current perspective, the demand for export shipping capacity in 2025 is expected to remain relatively stable. In the long term, automakers will increasingly focus on establishing overseas production facilities and assembly operations, with export models gradually shifting from whole-vehicle exports to component assembly, potentially weakening demand for roll-on/roll-off (RoRo) transportation. In terms of shipping capacity, a significant number of new ship orders are scheduled for delivery by 2025, which is expected to add over 500,000 standard vehicle slots to the market, significantly alleviating the current capacity shortage. In terms of ports, Guangdong and Anhui have already established relatively complete new energy vehicle supply chains and brand advantages, providing support for corresponding roll-on/roll-off (RoRo) services at ports; ports in Liaoning and other regions reliant on traditional fuel vehicle transshipment will continue to face downward pressure. Additionally, port RoRo transportation is still influenced to some extent by railway transport capacity and freight rates.

Summary

In 2025, China’s maritime transport market will exhibit complex and dynamic characteristics, maintaining an overall growth trend while facing multiple challenges. As a supplier of integrated port handling equipment, GBM actively participates in port construction, contributing to the development of China’s port industry and the prosperity of the logistics sector. With high-quality products, GBM serves as a strong contributor to market development.